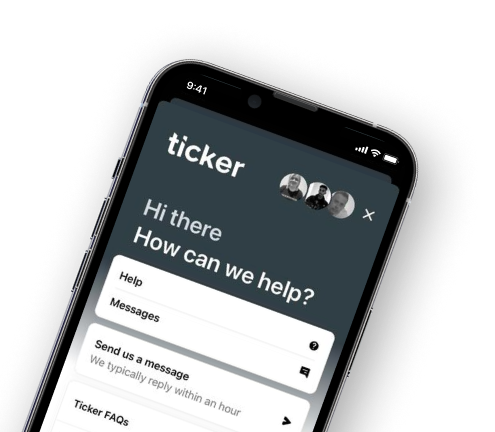

Start a chat with one of our agents for sales and service

Our customer service hours are 9am to 5pm, Monday to Friday and 9am to 1pm on Saturdays.

Start a chat

Ticker, one of the UK’s leading connected motor insurers, continues to expand with its fourth product: a pay-per-mile offering for low-mileage drivers. This is the latest product in a suite of connected motor propositions, which includes novice drivers, van drivers and electric vehicles.

As the cost-of-living crisis intensifies, demand for flexibility with household bills is rising. At the same time, take-up of connected motor insurance is increasing – and Ticker is at the heart of taking telematics from niche audiences to mainstream products.

Annual mileage has been trending down for years, but since the pandemic, Department for Transport data indicates that the average for a UK driver is now below 7,000 miles per year.1 More people working from home and greater awareness of climate issues has solidified low-mileage drivers as a growing norm.

Ticker’s pay-per-mile insurance has been carefully developed to answer the needs of today’s insurance consumers: better pricing for lower-mileage drivers, clearer sight of day-to-day journey costs and greater control over outgoings.

“We’re thrilled to be introducing pay-per-mile into our expanding suite of connected motor products. It’s a case of right product, right time – but its difficult to imagine a future where every insurer doesn’t have a usage-based product in its offering.“We’re very confident this product will succeed, for several reasons: our award-winning digital ecosystem and customer experience, very high levels of pricing sophistication resulting in market-leading loss ratio performance, and our use of machine learning and AI across many aspects of the business.”

Richard King

Founder and CEO of Ticker

Ticker is enjoying solid growth and, with products for convicted drivers and people new to the UK about to launch – and three more niche propositions planned for 2023 – the insurtech is forecasting over £100m of premium for the coming year.

The pay-per-mile product is live and already listed on Confused.com.