Low-mileage cover for driving less than 7,000 miles a year

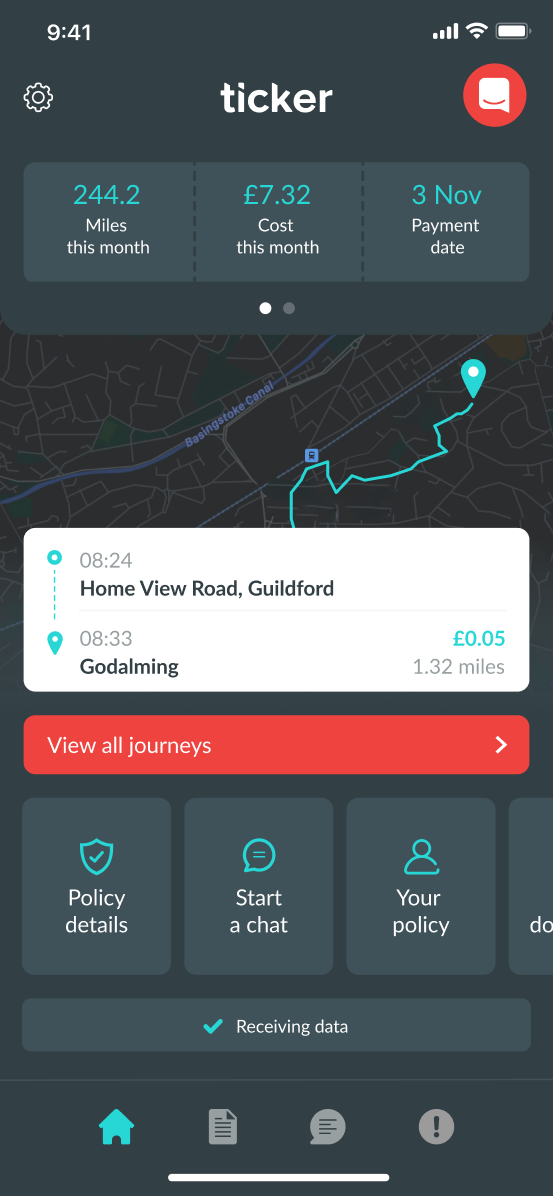

With Ticker pay-per-mile insurance, you’ll only pay for the miles you actually drive each month. No miles? No charge. Just pay as you go.

- Smaller upfront cost to protect your parked car from theft or damage

- Pay monthly for the miles you drive – with no penalties for how you drive

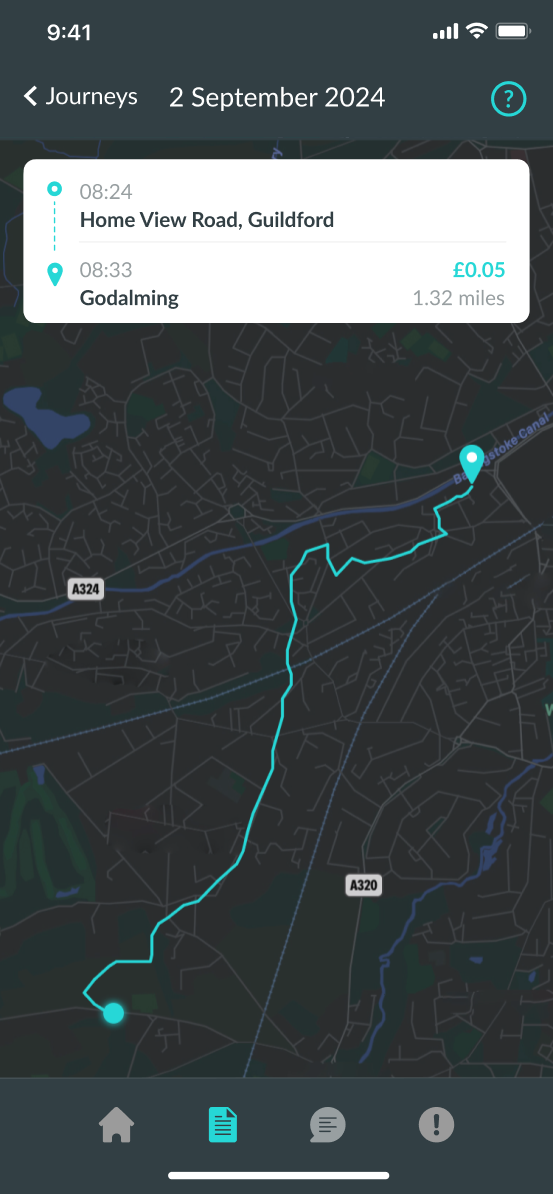

- Track your journeys and monthly costs in the Ticker app

- Manage your policy in the app and start a chat for help