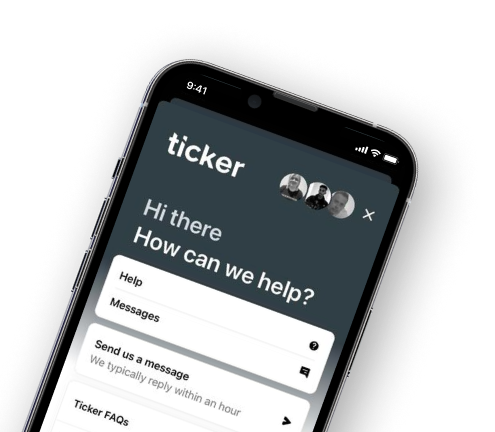

Start a chat with one of our agents for sales and service

Our customer service hours are 9am to 5pm, Monday to Friday and 9am to 1pm on Saturdays.

Start a chat

Freedom of movement is one of the most fundamental rights, and retirement should be a time to enjoy that right to its fullest. But among all the other rising costs, car insurance for those aged 65 and over has risen by 43% in just a year.1

A recent study2 also found that the UK provides the smallest state pension out of eight countries. Those on the highest amount of £11,500 a year still fall £3,000 short of what’s required for a ‘minimum’ standard of living.

People over 65 are living more active lives than ever, and financial pressures mean a growing number are also remaining in the workforce – all of which mean more reliance than ever on a vehicle. But with finite funds already stretched to capacity, it’s essential to keep the cost of driving as low as possible.

There are some tried-and-tested ways to make sure you’re getting the best quote possible, like checking your policy doesn’t auto-renew and shopping around on comparison websites. But many older drivers are already doing everything they can. Better access to telematics insurance could do a lot to reduce car insurance premiums, especially for these experienced drivers who know they drive carefully.

Ticker’s upcoming product aims to give older drivers all the information they need to feel secure on the road, as well as saving money for driving well.