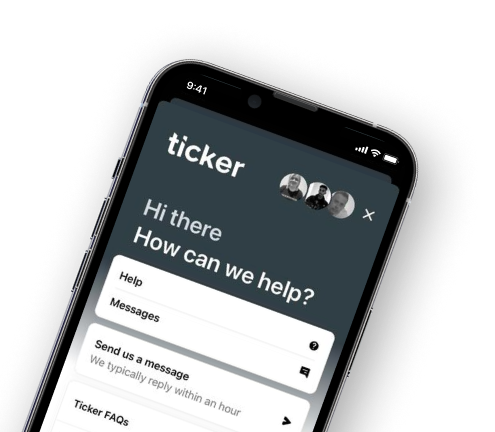

Start a chat with one of our agents for sales and service

Our customer service hours are 9am to 5pm, Monday to Friday and 9am to 1pm on Saturdays.

Start a chat

By Richard King, founder and CEO of Ticker

We had an excellent 2023, overachieving all our goals and targets. As we head into 2024, I wanted to share some of the major milestones we achieved last year.

We budgeted to write £96m of gross premium in 2023. I’m delighted to report that we exceeded our forecasts and wrote £107m of premium.

As I’ve often said since day one, we’ve had laser focus on underwriting profitability. I’m really proud that – through a combination of our team, experience, ecosystem, data science and pricing capabilities – we’re writing business at an attritional loss ratio of 50%. Our large loss experience also remains very impressive and market-leading.

In summer 2023, we added £6.4m into the investment pot, knowing this figure would see us beyond break even and into profitability. The raise was mainly with existing investors but also Andrew Burgess – a very experienced investor, as well as a highly skilled multinational chairman and non-executive director.

In addition to investing, I asked Andrew to consider joining us as Chairman. Subject to FCA approval, we will be working closely together in the next stage of growth for Ticker.

Andrew was previously a global partner at Carlyle and led the UK private equity team. Most notably, he was the driving force to acquire the RAC – including the insurance business – from Aviva for £1bn in 2011.

Our most significant achievement in 2023 was reaching profitability in November, ahead of forecast. We believe this makes us one of the first insurtechs in the UK to achieve this result.

This year, we’re budgeting to write £168m of premium with £28m of revenue, which will place us quite high up the league table for MGAs in the UK. We will also continue to launch new products to sit alongside our existing suite of propositions.

We therefore remain on track to hit our primary objective: to be the number-one in the UK for connected motor insurance.