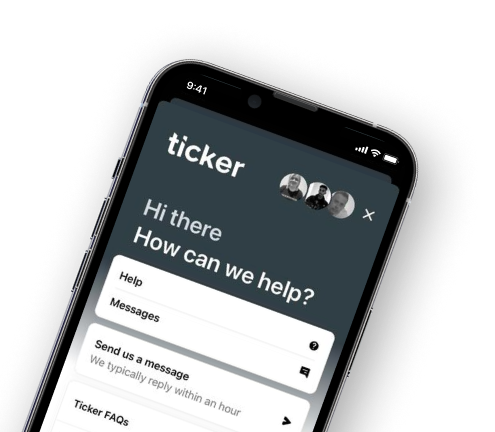

Start a chat with one of our agents for sales and service

Our customer service hours are 9am to 5pm, Monday to Friday and 9am to 1pm on Saturdays.

Start a chat

Driving convictions have been trending upwards for a decade and saw a 14% rise in 2022 compared with 2021.1 With rising insurance costs in the current economic climate, getting back to the road after a ban is quickly becoming unattainable for more and more drivers.

Once drivers have served their ban, the high cost of traditional insurance adds another punishment despite little evidence that people with previous convictions are likely to reoffend.2 Our convicted driver product provides an easier road back to affordable insurance.

We’ve designed our convicted driver insurance to give people the quickest and easiest route back to normality. Using a telematics device, we provide the driver with plenty of feedback to work towards regaining a No Claims Discount, as well as a renewal price based on their driving.

“A driving conviction or ban will cause a huge amount of disruption to a person’s life and could even result in a loss of livelihood. When they’re ready to get back on the road, high insurance premiums add an extra obstacle.“With the continuing cost-of-living crisis, it’s vital these drivers are supported back into good driving behaviour and fair premiums.”

Richard King

Founder and CEO of Ticker

Ticker’s mission is to bring connected motor insurance to a much wider market, with propositions for the majority of UK drivers – and convicted drivers are the next group to benefit.

1 Criminal Justice System statistics quarterly: June 2022

2 Proven reoffending statistics: July to September 2020

These cookies make things like saving your quote work. As the name suggests, they’re vital for giving you the experience you’ve come to Ticker for. They’re always active, so you agree to them by continuing to use the website.

These cookies help everything run smoothly. Without functional cookies, things might not work as they should, like chat and FAQs.

Performance cookies help us analyse how well the website is working so we can keep improving it for our customers.

This type of cookie lets us tailor our marketing to you, according to how you’ve interacted with other sites.