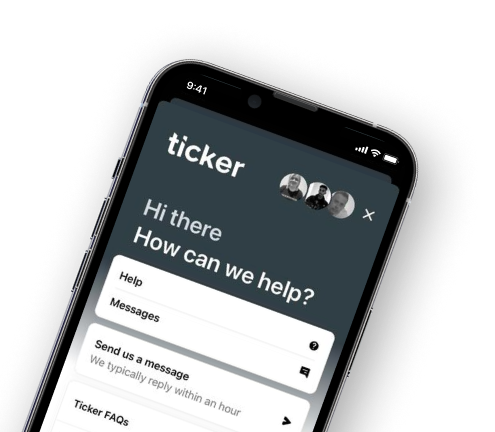

Start a chat with one of our agents for sales and service

Our customer service hours are 9am to 5pm, Monday to Friday and 9am to 1pm on Saturdays.

Start a chat

Ticker was created to take connected insurance to a much wider market, and the growing demand is clearly showing we’re on the right mission.

According to a recent survey from GlobalData, the uptake of telematics devices among under-30s went up 28.6% between 2020 and 2021.

The benefits of connected insurance aren’t just for a select group of drivers, and we’re identifying new audiences who can lower their costs.

We have two products live today (novice and van) and will have eight by the end of the year, including propositions for low-mileage drivers, older drivers, convicted drivers, drivers new to the UK and electric vehicles.

These groups can’t be served with a one-size-fits-all product: we build tailored propositions ideally suited to each customer experience.

“Telematics can unlock discounts for good drivers…this will become especially important as the cost-of-living-crisis continues.”Benjamin Hatton

GlobalData insurance analyst

“Connected insurance is one area where consumers can have more control over what they pay – whether that’s getting a better price based on good driving or by switching to a flexible pay-per-mile policy.”Richard King

Ticker founder and CEO