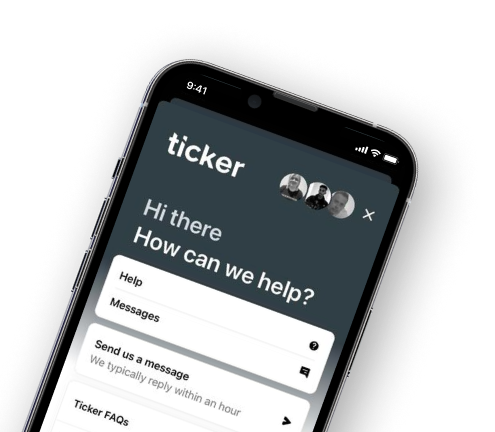

Start a chat with one of our agents for sales and service

Our customer service hours are 9am to 5pm, Monday to Friday and 9am to 1pm on Saturdays.

Start a chat

Since telematics hit the insurance world in 2010, the tech has been associated with young drivers. It’s helped reduce the cost of insurance, reduce crashes and reduce the worry every parent feels as their child drives away from them for the first time.

Insurance premiums have come down dramatically and, according to a report by LexisNexis in November 2018, telematics has played a vital role in cutting crashes by more than a third for this age group since 2011.

With those results, it’s now surely time that telematics increases its reach. There are limited pockets where other drivers are benefiting from the technology but telematics insurance needs to go mass-market. And that’s what we’re aiming to achieve with Ticker.

A number of things came together in the founding of Ticker: this idea of mass-market telematics and a new box that was unlike anything previously used in insurance. The opportunity to use a self-installable device that’s autonomous to the vehicle, at a much lower price point, opened up the application of telematics far beyond young drivers.

We’ve started with novice and van driver products, which is a market of around eight million drivers. Over the next year, we’ll add several more propositions that will give us a target audience of close to 13 million UK drivers.

Another major factor in the creation of Ticker was the offer of an MGA agreement from Munich Re’s Digital Partners and investment from Munich Re Ventures.

We all know it’s the people that make any business successful. With Ticker, we’ve brought in some of the biggest names in the industry as Board members, senior management and advisors – including insurance legends Adrian Brown (ex-RSA) and Barry Smith (ex-Ageas).

They were not only drawn to the track records of the founders and the idea itself; it was also the opportunity to start from a blank sheet and create something new, without being stifled by legacy systems.

In addition to the founders and Munich Re Ventures investing a considerable sum, we’re also supported by external investment from Gary Lineker, Theo Paphitis, Mark Blundell (ex-F1 driver) and Sir Martin Broughton, former chairman of British Airways and a past president of the CBI.

Just under £5m in seed capital was invested to kick-start the business.

Besides Munich Re, we secured some of the best partners in the market. With every name added to the line-up, it’s felt like we’re building the ultimate fantasy football team.

Willis Towers Watson have worked closely with our own team of underwriters and pricing analysts to build our car and van rates.

ICE Insuretech, part of Acturis, have provided us with one of the most flexible and agile Policy Administration Systems in the market.

The award-winning sales and service provider, Hood Group, is building our centre of excellence for customer support.

We’re combining data from underwriting, pricing, telematics, claims and operations for a seamless view of our customer. This then forms a continuous feedback loop, which we can act on to make rapid adjustments, particularly in pricing.

But it’s not only the technology; the people from all these different areas of expertise work together so there’s a completely holistic approach across the company. Because ‘departments’ don’t exist in the traditional sense, there are no data silos.

An insurance super group. The partnership with Munich Re’s Digital Partners. A completely new approach to telematics and data. Support from the who’s who of investors. A line-up of top-flight partners.

With all these things coming together, Ticker has the best possible foundation from which to compete with the direct insurers.

However, start-ups can often get obsessed with trying to create a new market, and rely on PR to drive up their value. We’re focusing on the two most important things for attracting profitable volume and ensuring Ticker’s mass-market success: underwriting and claims.

Bright people, smart technology – but it’s the fundamentals that will make Ticker successful.